💰Genius Bill Passed into Law, What's Next for Stablecoins?

|

Hey Reader, In today's issue:

💸Sponsored by: Fiscal.ai Investing without the right tools is a challenge. That's why Andrew and I use Fiscal.ai daily. It helps us find and analyze companies' fundamentals, the key to finding profitable investments. With Fiscal.ai, investors can get:

And much, much more! Check out Fiscal.ai today with a two-week trial and see why we like it so much.

💎NUGGETS My Favorite Finds 📖 GENIUS bill passed into law, now what for stablecoins and beyond? 📖 Curated reading list from one of my authors, Leandro of Best Anchor Stocks: (F) Best Anchor Stocks best articles.pdf 🎥 Great video interview of Joel Greenblatt dropping all kinds of value investing nuggets. 🎥 Aquired Podcast video interview of Jamie Dimon and how he great JP Morgan to a $800 million market cap. 📻 Awesome podcast with Kervin Pillay, former CTO of Cisco on AI data centers (he's been building them for 25 years). 📖 Eric Flaningam breaks down the opportunity in AI and healthcare. 🔍Question of the Week

📖Knowledge Tidbits

Thanks,

|

Hi! Welcome to Investing for Beginners

Unlock the mysteries of the stock market with us! We break down complex topics into simple, easy-to-understand language. Join over 21,000+ readers who receive our insights every Tuesday.

Hey Reader,Did you know that before becoming a successful investor, Mohnish Pabrai bootstrapped his IT consulting company TransTech in 1991 with just $30,000 from his 401(k) and $70,000 from credit card debt. He later sold this company for $20 million in 2000. In today's issue: The math behind Buffett's position sizing, the answer surprise me. Where do tech returns come from and how will they look in the future? Breakdown of how to analyze an income statement visually. Much more........

Hey Reader,Terry Smith of Fundsmith believes that owning a great business that can compound its value over many years is far more beneficial than buying a mediocre company at a cheap price. He often quotes Warren Buffett: "It is better to own a great company at a fair price than a fair company at a great price," because the great business is a "gift that can keep on giving" long after a cheap stock has simply reached its fair value. In today's issue: How to estimate growth in a DCF with...

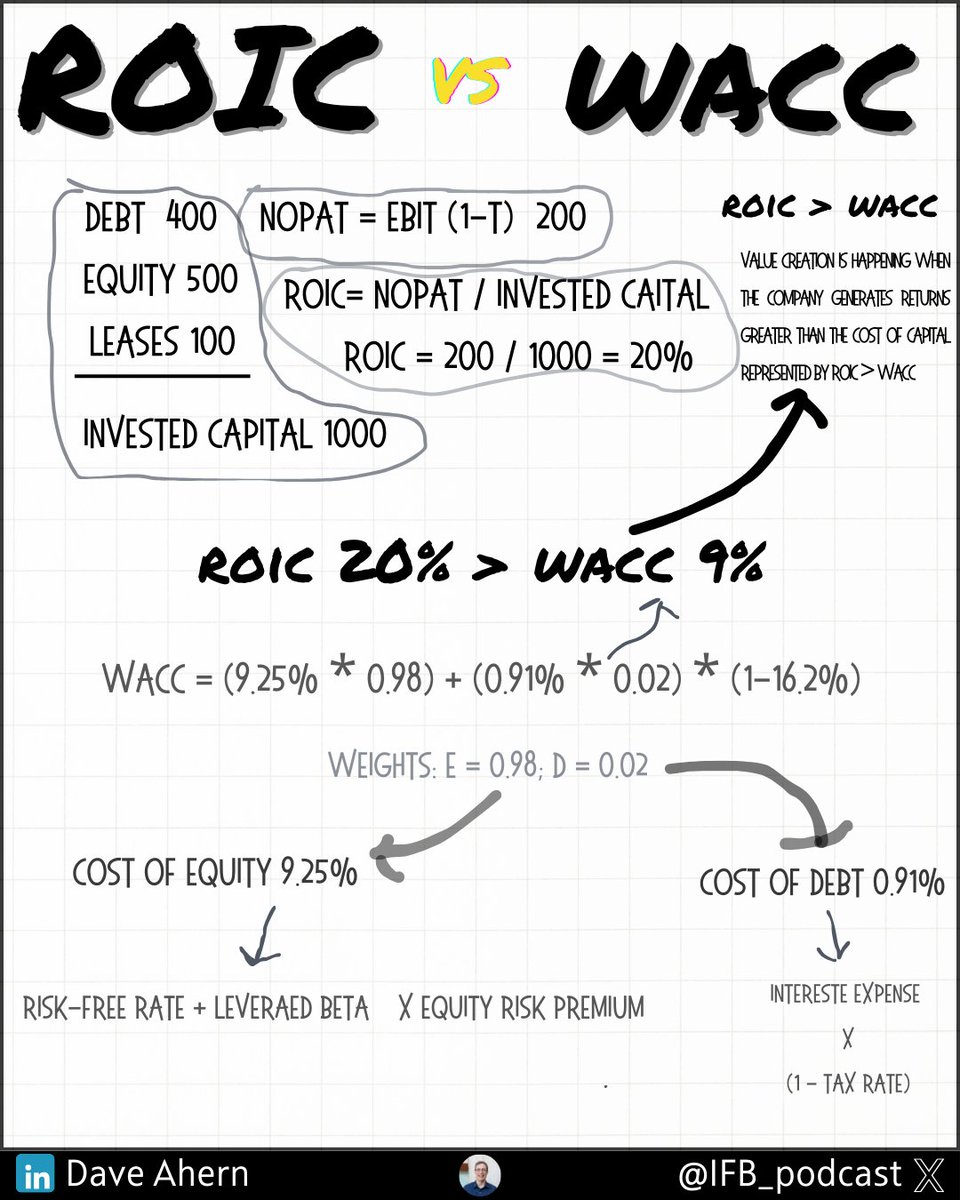

Hey Reader,Did you know that the S&P 500's lowest recorded P/E ratio was 5.31 in 1917, while its highest was 123.73 in May 2009, during the financial crisis? This represents a range of over 2,200% between the most undervalued and overvalued market conditions, demonstrating how dramatically valuation perspectives have shifted across different economic eras. In today's issue: Warren Buffett breaks down how he would invest if he could start over. What is never sell really? Why ROIIC is more...